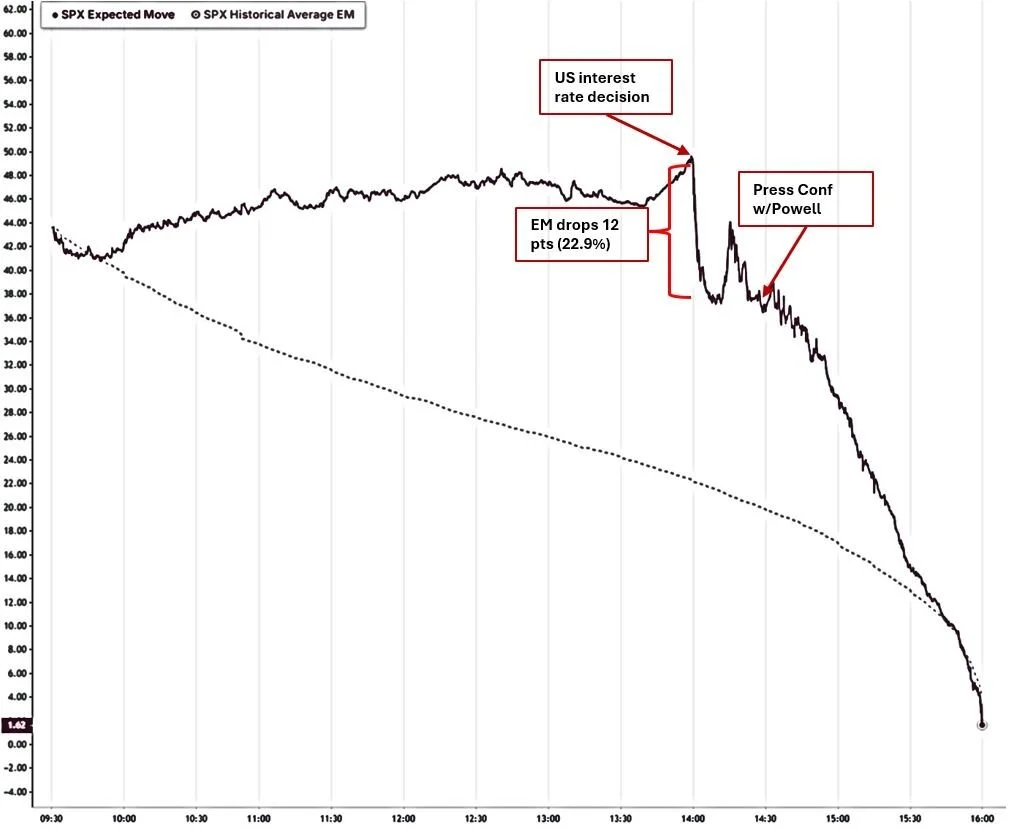

Structural Calm, Embedded Convexity

Between calm realised volatility and elevated forward risk, markets reflect both muted short-term moves and embedded macro risk premia. In this Volatility Brief, we examine Powell’s ‘higher-for-longer’ stance, JPM’s collar roll, AI-driven overvaluations, and our strategy positioning across gamma, vega, skew, and beta.

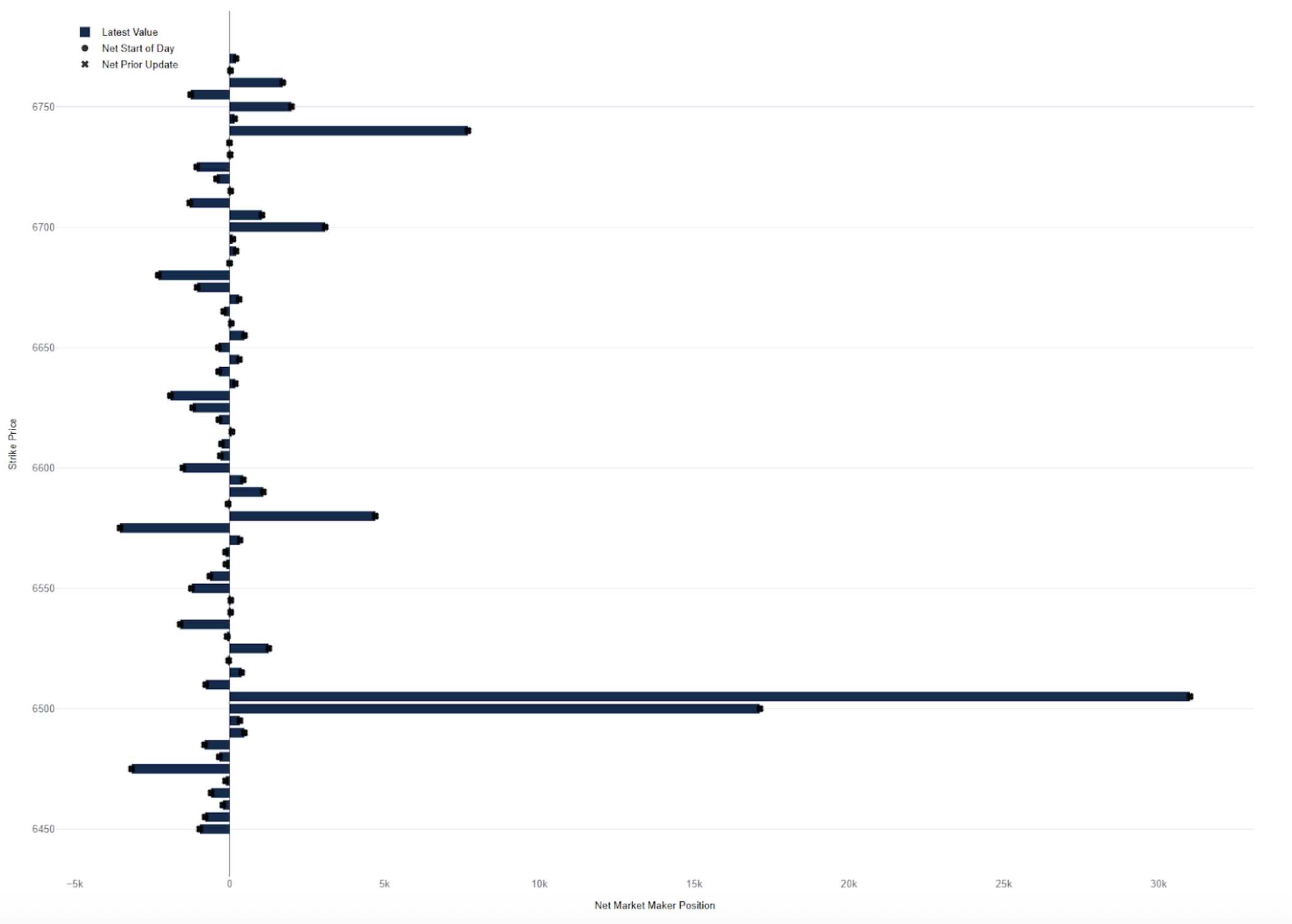

Fed Rate Cut

The Federal Reserve’s latest rate cut offered a fascinating real-time study in volatility. Even when policy moves are widely anticipated, the manner of the market’s reaction can reveal subtle but important signals.

Independence Day Market Dynamics

Despite the continued strength in equities, the volatility complex remains resilient. On Independence Day, the S&P 500 advanced by 0.73%, yet the front end of the volatility curve barely moved lower. This is noteworthy: roll yield is carrying materially better than expected given the steepness of the curve.

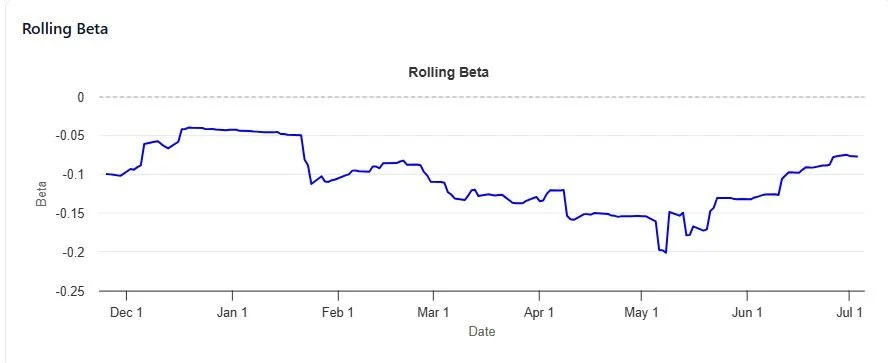

Anatomy of a Sell-Off: Why Convexity Matters

The sharp SPX sell-off and VIX surge on 3rd April 2025 underscored why convexity is critical in modern portfolio construction. As volatility spiked and the VIX curve flipped into backwardation, convex strategies demonstrated their power — delivering protection and positive returns when traditional assets came under pressure.