Anatomy of a Sell-Off: Why Convexity Matters

Today delivered a clear demonstration of why convexity is indispensable in portfolio construction.

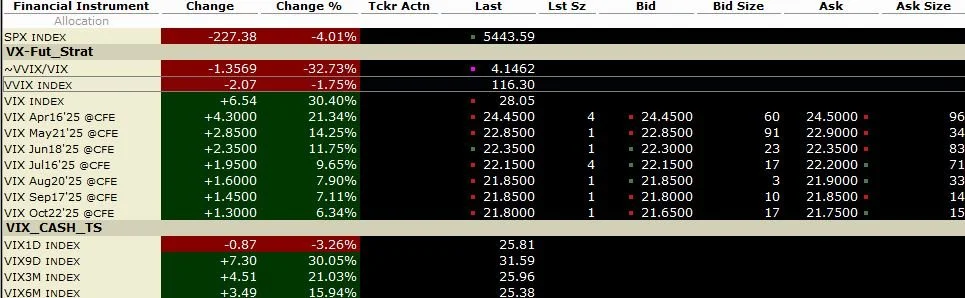

Following yesterday’s tariff announcements, equities came under sharp pressure — the S&P 500 fell -4.01% to 5,443, while the VIX Index surged +30.40%, closing above 28.

As the accompanying charts show, this was not a spot VIX anomaly. The entire VIX futures curve repriced aggressively: front-month contracts jumped more than six volatility points, and the curve inverted into steep backwardation — a classic marker of acute market stress.

Moments like this highlight why convex strategies are not simply a “nice-to-have,” but a fundamental element of robust portfolio design. Convex payoffs are specifically structured to benefit non-linearly from sharp market moves and volatility shocks — providing both protection and the potential to generate positive returns when traditional assets are under severe pressure.

At BlackShip, this principle is core to our investment philosophy. By deliberately maintaining convex exposures, we are structurally positioned to benefit when volatility regimes shift abruptly. On a day when global equity markets declined sharply, this discipline has translated into our best single-day performance since launch.

This is not about forecasting direction. It is about being structurally prepared for the inherent non-linearities of markets — and today is a powerful reminder of the importance of that preparation.